Welcome to the online version of the Summer 2018-19 issue of NEWS: Financial Aid for Gators — a publication produced once a semester to keep students informed of important developments in financial aid.

Featured in this issue:

#SS18summer2018 Summer Financial Aid Information

#SS18budgetBudgeting Tips for Students

#SS18eligibleStay Eligible for Financial Aid

#SS18directSign Up for Direct Deposit

#SS18verificationHas Your FAFSA Been Selected for Federal Verification?

#SS18questionsHave Financial Aid Questions or Need Additional Information?

#SS18moreand Additional SFA Information

2018 Summer Financial Aid Information

If you enrolled in classes during the Summer 2018 semester and would like to apply for available financial aid, follow these steps:

- Talk to your academic adviser. You will want to plan your schedule in advance and ensure you enroll in the correct classes.

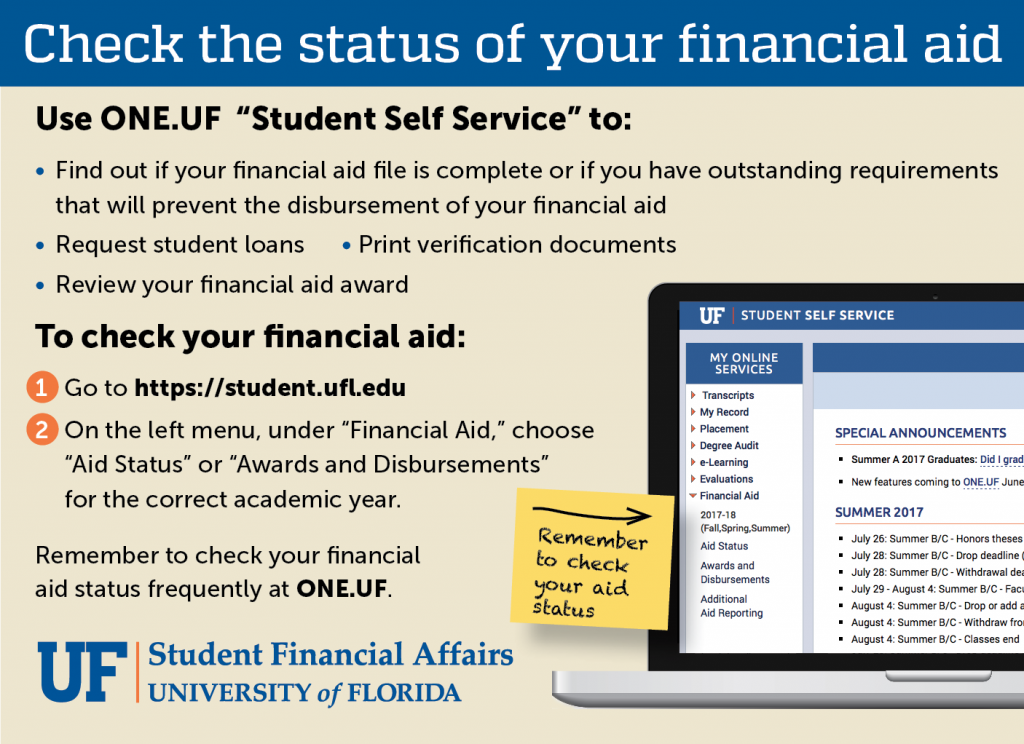

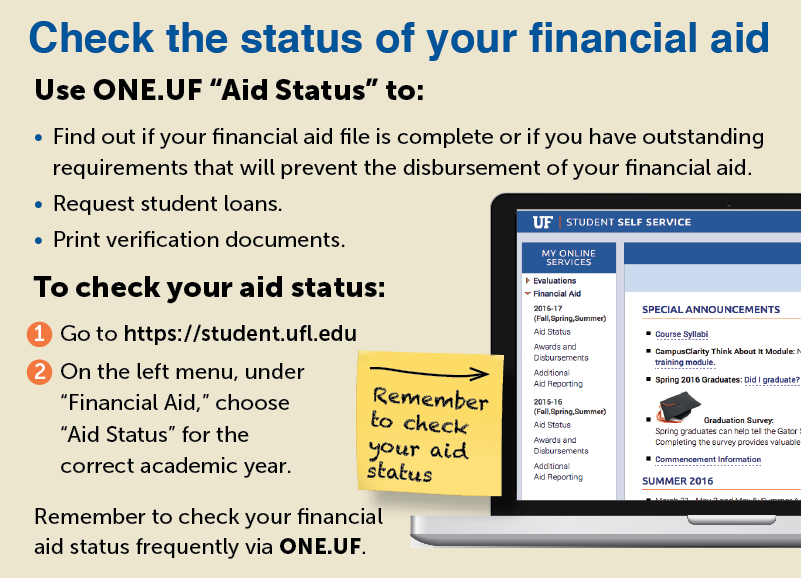

- Go to the 2017-2018 Financial Aid Status Page at https://student.ufl.eduhttps://student.ufl.edu and complete the instructions found at the Summer Financial Aid Request link.

If you are paid financial aid based on your enrollment, and subsequently drop classes, you may be placed into repayment.

Please note that 2018 summer Bright Futures funding is only available for eligible Florida Academic Scholars and Innovation Academy students.

Receiving Summer Aid

Your financial aid will be awarded based on projected full-time enrollment for Summer.After summer A/C drop/add ends, your budget will be revised to reflect your actual costs and your aid may be adjusted based on your total enrollment for Summer A, B, and C classes.

Your aid will be disbursed after you begin summer attendance. If you are enrolled during Summer A/C, and your total summer enrollment (Summer A, B, and C) is at least half-time, then your financial aid for the entire summer will be disbursed up-front. If you are enrolled only in classes during Summer B, your aid will not be released until your classes begin.

Tuition/fees for summer will be calculated based on your total enrollment for Summer A, B, and C. All unpaid tuition/fees and housing charges will be deducted from your financial aid before disbursement.

Most aid programs require that you enroll at least half-time.

Federal Work-Study students must enroll for at least six credit hours to be eligible to work during the summer.

Your financial aid will be disbursed based upon your total enrollment for Summer A, B, and C classes.

If you are paid financial aid based on your enrollment, and subsequently drop classes, you may be placed into repayment. Be sure to communicate with your academic adviser and financial aid adviser prior to making changes to your schedule.

UF Policy Summer Attendance

The academic year at UF consists of three semesters beginning with fall and ending with summer. Freshmen and sophomores entering the State University System must complete at least nine credit hours during a summer session to graduate, with the exception of the student who earns nine credit hours via the Bright Futures acceleration mechanism. SFA supports this requirement, and summer money may be offered if:

- Federal or institutional funds remain for summer awards after fall and spring semester needs are met; or

- You choose to attend summer session instead of one of the other two semesters (for instance, attend fall and summer semesters and work spring semester) and you are awarded for fall/spring initially and notify us of your decision to attend summer instead of fall or spring. Students should go to https://student.ufl.edu, click on the appropriate academic year, then “Aid Status,” and complete the Summer Aid Request. See enrollment requirements for receiving aid.

For more information, contact a financial aid adviser. http://www.sfa.ufl.edu/contact-sfa/http://www.sfa.ufl.edu/contact-sfa/www.sfa.ufl.edu/contact-sfa

Budgeting Tips for Students

While you’re in college, you’ll need to learn how to manage your finances, plan for changes, and prepare for the unexpected. Budgeting will help you build decision-making skills and help you reach your financial and academic goals.

- Overestimate your expenses.

It’s better to overestimate your expenses and then underspend and end up with a surplus. - Underestimate your income.

It’s better to end up with an unexpected cash surplus rather than a budget shortfall. - Differentiate between needs and wants.

One benefit of budgeting is that it helps you determine if you have the resources to spend on items that you want versus those you need. - Involve your family in the budget planning process.

Determine how much income will be available from family sources such as parents or a spouse. Discuss how financial decisions will be made. - Prepare for the unexpected by setting saving goals to build an emergency fund.

– Budgeting will help you cover unusual expenses and plan for changes that may happen while you’re in school.

– Planning to move off campus? Short-term budgeting goals for the year can include saving for the rent deposit and furniture for your new apartment.

– Starting an internship next semester? Adjust your budget to save for buying new clothes to wear to work and paying increased transportation costs.

– Finishing school in the next year? Budget to include job search expenses such as résumé preparation, travel to interviews and job fairs, and professional exam fees. Also, you may need to think about how you will manage your money between leaving school and finding a job—this is a time when an emergency fund can really help out. - Expect the unexpected.

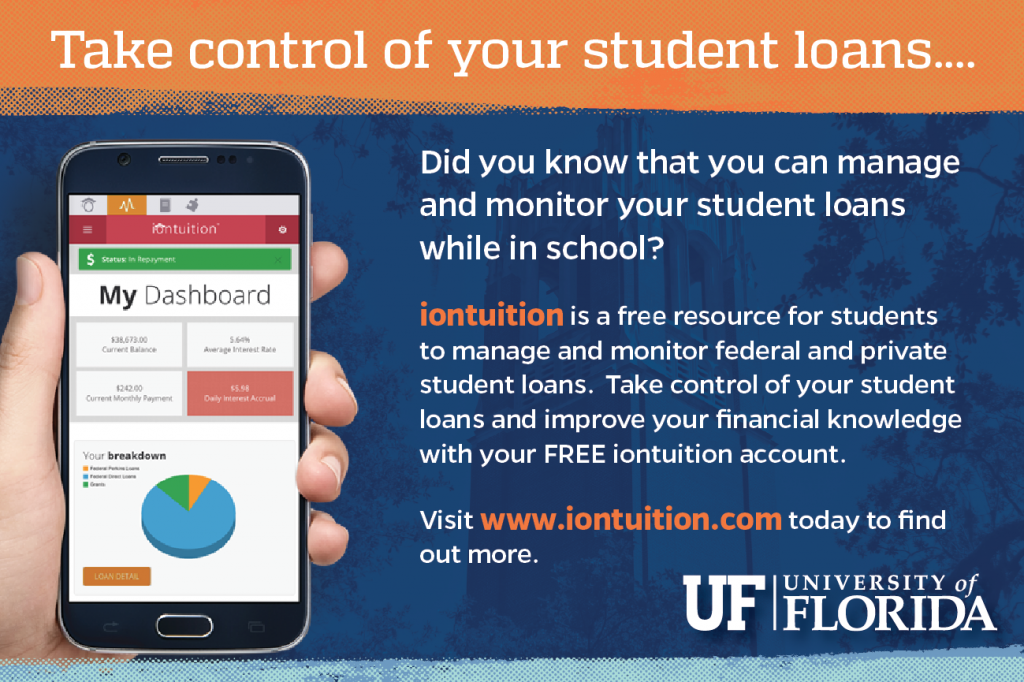

Your emergency fund should be used for expenses that fall outside the categories of annual and periodic bills. Redefine your notion of “unexpected” bills to encompass these unforeseen events rather than more common but infrequent expenses. The good news is that if you do not use your emergency fund, you will have savings—which should always be a priority when managing your finances. And, if you do not have to use your emergency fund, you may avoid unnecessary borrowing. - Only borrow what you need.

If your living expenses are not going to be as high as the amount on your award letter, you have the right to turn down the loan or to request a lower loan amount. If you have any questions or don’t understand what types of loans are in your award letter, contact your adviser. Always ask questions and be an informed borrower. Make sure you understand what you’re receiving and the repayment terms.

Stay Eligible for Financial Aid

You need to make satisfactory academic progress in order to continue receiving federal student aid. In other words, you have to make good enough grades, and complete enough classes (credits, hours, etc.), to keep moving toward successfully completing your degree.

Students who fail to meet the following criteria will be ineligible for federal, state, and/or institutional scholarship and grant funds:

- maintain the required cumulative grade point average,

- successfully complete the required percentage of attempted coursework,

- complete their program of study within the prescribed length of time.

Read about the quantitative and qualitative components you must meet to maintain your eligibility for financial aid on SFA’s http://www.sfa.ufl.edu/process/additional-information/satisfactory-academic-progress-policy/Satisfactory Academic Progress webpage.

Sign Up for Direct Deposit

UF now requires that all students receiving financial aid sign up for direct deposit.

To sign up, go online to https://my.ufl.edu/https://my.ufl.edu/ and select “Access myUFL” to login. On the top toolbar, select “Main Menu.” Choose “My Campus Finances,” then “Direct Deposit–Student or PLUS.”

Direct Deposit is the quickest and safest way to receive your financial aid refunds.

Please direct any questions about direct deposit to the University Bursar (UB) at (352) 392-0737.

#top#top#top#top#top#top» top

Has Your FAFSA Been Selected for Federal Verification?

You may receive emails from UF Student Financial Affairs alerting you that you have been selected for verification. “Federal Verification” is a review process, mandated by the federal government, to check the accuracy of information reported on financial aid documents submitted by students and their families. Nationwide, the federal government selects more than 30 percent of student financial aid applications for verification.

If your application is selected for verification, check your financial aid “to do” items at https://one.uf.edu/ONE.UF to determine what documents to provide.

Aid funds cannot be disbursed to you until you have submitted all requested documents and the accuracy of the information has been reviewed. Aid funds already disbursed may be entered into repayment if documentation is not received.

Verification Tips

- Submit all documents requested by SFA as soon as possible.

- Be sure all documents are signed.

- Be sure your name and UFID are on all documents you submit.

- To request a Tax Return Transcript and/or W-2 information, call the IRS at 1-800-908-9946 or go online to https://www.irs.gov/Individuals/Get-Transcripthttps://www.irs.gov/Individuals/Get-Transcript.

- Keep photocopies of all information you submit and record the date you submitted the documents.

- Keep photocopies of all W-2’s and request an IRS Tax Return Transcript to keep on hand.

IRS System for Ordering Tax Return Transcripts

The IRS system for ordering tax return transcripts is now available. It is called “Get Transcript” and allows users to get a record of past tax returns, also referred to as tax return transcripts. IRS tax return transcripts are used to validate income and tax filing status. http://www.irs.gov/Individuals/Get-Transcripthttp://www.irs.gov/Individuals/Get-Transcript

#top#top#top#top#top#top» top

Have financial aid questions or need additional information?

The quickest way to get assistance with your financial aid is to submit your request online at http://www.sfa.ufl.edu/help/http://www.sfa.ufl.edu/help/www.sfa.ufl.edu/help.http://www.sfa.ufl.edu/help/http://www.sfa.ufl.edu/help/ Undergraduate and graduate students may request additional information or ask financial aid questions:

Undergraduate and graduate students may request additional information or ask financial aid questions:

- Online at http://www.sfa.ufl.edu/help/http://www.sfa.ufl.edu/help/www.sfa.ufl.edu/help

- By phone at 352-392-1275

- In person in the Student Financial Affairs’ main office located in S-107 Criser. SFA is open Monday-Friday, 8:00 am – 5:00 pm (excluding holidays and UF closings).

Undergraduate students enrolled in UF Online can get assistance with financial aid:

- By phone at 352-294-3290

- By email at mailto:ufonlineonestop@mail.ufl.eduufonlineonestop@mail.ufl.edu.

Visit the http://www.sfa.ufl.edu/resources/calendar/SFA Calendar for important dates and deadlines.

Contact information for your financial aid adviser is available on http://www.sfa.ufl.edu/contact-sfa/http://www.sfa.ufl.edu/contact-sfa/SFA’s Contacts webpage.

Summer 2018 SFA News

The Summer 2018 issue of NEWS: Financial Aid for Gators — is available in http://www.sfa.ufl.edu/pub/news/1718SummerNews_email.pdfPDF format for Summer 2018.

NEWS: Financial Aid for Gators is produced once a semester by the Information/Publication Services section of the Office for Student Financial Affairs, to inform students about financial aid programs and services that help UF students meet educational costs.

Director: Rick Wilder

Editor: Sharon Eyman

NEWS: Financial Aid for Gators is available in other formats for students with documented, print-related disabilities. Students who are speech- or hearing-impaired can contact the Florida Relay Service. Dial 711 or 1-800-955-8771(TTY) http://www.ftri.org/FloridaRelayhttp://www.ftri.org/FloridaRelay

The University of Florida is committed to equal treatment of students without regard to race, creed, color, religion, age, disability, sex, sexual orientation, marital status, national origin, political opinions or affiliations, or veteran status.

http://www.sfa.ufl.edu/contact-sfa/http://www.sfa.ufl.edu/contact-sfa/Contact SFA

UF Federal School Code: 001535

Visit SFA on Social Media https://www.facebook.com/UFSFAFacebook https://twitter.com/UFSFATwitter https://www.instagram.com/ufsfa/Instagram https://www.youtube.com/user/UFSFAYouTube