Welcome to the online version of the Fall 2017-18 issue of NEWS: Financial Aid for Gators — a publication produced once a semester to keep students informed of important developments in financial aid.

Featured in this issue:

#applyApply for 2018-19 Financial Aid on October 1

#BFUpdate2017-18 Bright Futures Update

#PellYear Round Pell Grant Update

#BFFlorida Bright Futures Renewal Requirements

#abroadInformation and Financial Aid Assistance for Study Abroad

#eligibleStay Eligible for Financial Aid

#consumerConsumer Information

#statusF18Check your Financial Aid Status at ONE.UF

#creditCredit Card Tips

#markMark your Calendar to Apply for 2018-19 Financial Aid

#moreand additional SFA information

Apply for 2018-19 Financial Aid on October 1

To apply for financial aid, complete the Free Application for Federal Student Aid (FAFSA) at https://studentaid.gov/fafsahttps://studentaid.gov/fafsahttps://studentaid.gov/fafsahttps://studentaid.gov. You can file a 2018-19 FAFSA as early as October 1, 2017. UF’s “On-Time” deadline to receive the results of your 2018-19 FAFSA from the federal processor is December 15, 2017. Apply well before December 15 to ensure that the federal processor has time to analyze and send the results of your FAFSA to our office. Financial aid is awarded on a first-come, first-served basis so apply as early as possible to be considered for the most, and best aid. In order for us to consider you for a financial aid package, you must be a degree seeking admitted student and have met the “On-Time” deadline.

What can students do to prepare for 2018-19?

- Use Your FSA ID

Create an FSA ID at https://studentaid.gov/studentaid.gov. An FSA ID gives you access to Federal Student Aid’s online systems and can serve as your legal signature. You must have an FSA ID before you can file a FAFSA. - Apply Online

SFA recommends filing online using the FAFSA website. Filing an online FAFSA can save you weeks of processing time. The online application also has edit checks to catch errors. The online application is available at https://studentaid.govstudentaid.gov. - Apply Early

Apply starting October 1, 2017. For your application to be considered “On-Time,” SFA must receive your FAFSA results, with a calculated Expected Family Contribution (or EFC), by December 15, 2017. Keep in mind that you are submitting your FAFSA to the federal government, not to the University of Florida. Submit your FAFSA weeks before the December 15 deadline so that there is enough time for your FAFSA data to reach our office before the deadline. Apply as early as possible to be considered for the most, and best aid. - Use the IRS DRT

The 2018-19 FAFSA will use 2016 income and tax information for students and parents. Use the IRS Data Retrieval Tool (DRT) when possible to automatically import your tax information into your FAFSA. - Reapply Every Year

Don’t make the mistake of assuming that financial aid magically renews itself—students must reapply each year by filling out the FAFSA.

Have questions or need help?

Get free assistance and answers at https://studentaid.gov/fafsahttps://studentaid.gov/fafsahttps://studentaid.gov/fafsastudentaid.gov or 1-800-433-3243 or make an appointment with your financial aid adviser.

http://www.sfa.ufl.edu/contact-sfa/http://www.sfa.ufl.edu/contact-sfa/http://www.sfa.ufl.edu/contact-sfa/http://www.sfa.ufl.edu/contact-sfa/www.sfa.ufl.edu/contact-sfa

#top#top#top#top#top#top#top#top#top#top» top

2017-18 Bright Futures Update

In July, the Office for Student Financial Affairs revised financial aid award letters for eligible students receiving a 2017-18 Bright Futures Florida Academic Scholars Award. The revised award reflects 100% tuition and applicable fees plus a $300 stipend that can be used for college-related expenses for the fall and spring terms. Recipients of the Bright Futures Florida Academic Scholars Award will also be eligible for funding for summer 2018. Additional information is available about http://www.sfa.ufl.edu/news/2017-18-bright-futures-update.2017-18 Bright Futures.

#top#top#top#top#top#top#top#top#top#top» top

Year-Round Pell Grant Update

Year-round Pell Grant is available starting with the 2017-2018 academic year. This allows for a student to receive 150% of a Pell Grant during an award year. Students can now take courses during the summer term that will allow them to graduate faster. To be eligible for the additional 50%, a student must be enrolled for at least 6 credit hours which is considered half time enrollment. Additional information is available about https://studentaid.gov/understand-aid/types/grants/pellYear-Round Pell.

#top#top#top#top#top#top#top#top#top#top» top

Florida Bright Futures Renewal Requirements

- All Bright Futures recipients are required to meet minimum credit hour and GPA requirements in order to renew their award each year. Students enrolled full time for both semesters are required to earn at least 24 semester hours in order to renew their award at the end of each academic year. For students not enrolled full time for both semesters, the hours required to renew are prorated.

- Students who do NOT earn the credit hours for which they were funded by the end of the evaluation period will be TERMINATED from the scholarship program.

- Students who do NOT earn their program’s required GPA at the end of their first evaluation period will be permitted a one-time restoration opportunity. Traditional students receiving funding during fall/spring will be permitted a one-time summer opportunity. Innovation Academy students receiving funding during spring/summer will be permitted a one-time fall opportunity.

Bright Futures Renewal Predictor

Determining exactly how many hours you will need to renew your particular Bright Futures award can be confusing. SFA has created a http://www.sfa.ufl.edu/programs/bright-futures/renewal/Renewal Predictor to aid you in determining your individual renewal requirements.

For more information, students should contact the FDOE Office of Student Financial Assistance at 1-888-827-2004. http://www.floridastudentfinancialaid.org/www.floridastudentfinancialaid.org

Florida Bright Futures Repayment Policy

- Students will be required to repay their award hours for any course dropped or withdrawn after the drop-add period.

- Hours repaid for dropped or withdrawn courses are added back to the student’s total semester hours available, and are not included in the student’s total credit hours required to renew the award.

- Repayment for the cost of dropped or withdrawn award hours is required to renew a Bright Futures award for the subsequent academic year.

- Nonpayment of dropped or withdrawn Bright Futures award hours may also negatively affect renewal eligibility for other state programs.

#top#top#top#top#top#top#top#top#top#top» top

Information and Financial Aid Assistance Available for Study Abroad

Student Financial Affairs has a Study Abroad financial aid coordinator who is dedicated to advising students on financial aid matters for their overseas studies.

For assistance with financial aid for Study Abroad, contact Allison Costa in S-107 Criser Hall, via phone at 352-294-3228 and email at mailto:allisoncosta@ufl.eduallisoncosta@ufl.edu. Allison will be at the UF Study Aboard Fair on September 20, 2017 from 10am-3pm at the Reitz Union North Lawn.

Information on financial aid for Study Abroad programs is also available on the SFA http://www.sfa.ufl.edu/additional/study-abroad/Study Abroad webpage .

#top#top#top#top#top#top#top#top#top#top» top

Stay Eligible for Financial Aid

You need to make satisfactory academic progress in order to continue receiving federal student aid. In other words, you have to make good enough grades, and complete enough classes (credits, hours, etc.), to keep moving toward successfully completing your degree.

Students who fail to meet the following criteria will be ineligible for federal, state, and/or institutional scholarship and grant funds:

- maintain the required cumulative grade point average,

- successfully complete the required percentage of attempted coursework,

- complete their program of study within the prescribed length of time.

Read about the quantitative and qualitative components you must meet to maintain your eligibility for financial aid at the http://www.sfa.ufl.edu/process/additional-information/satisfactory-academic-progress-policy/Satisfactory Academic Progress webpage.

#top#top#top#top#top#top#top#top#top#top» top

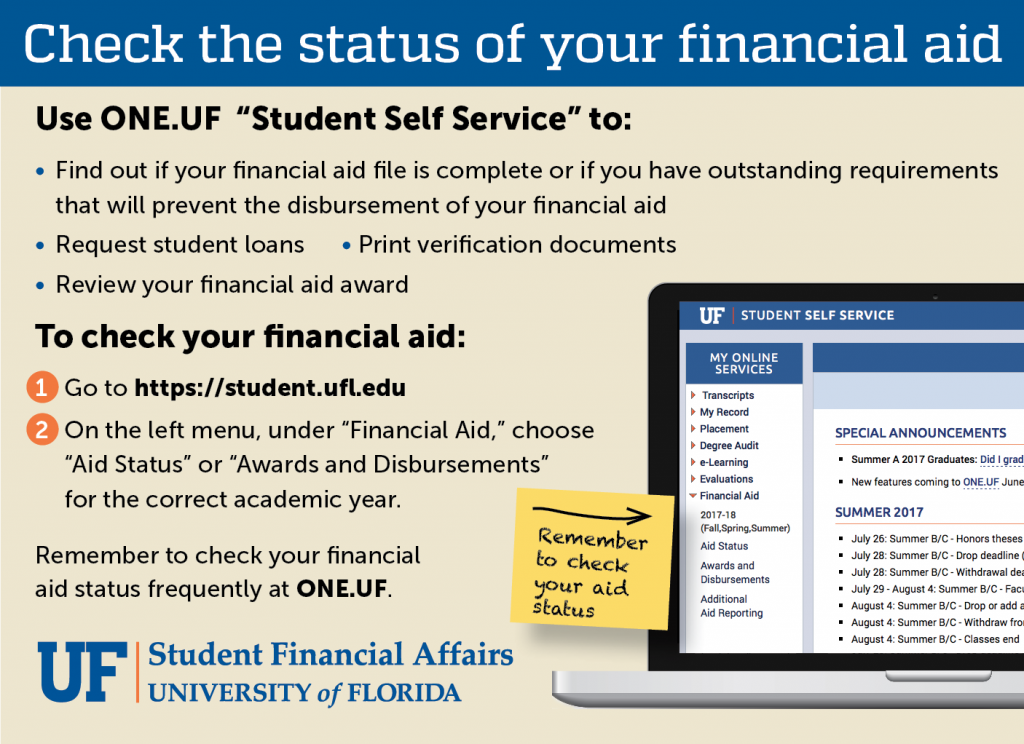

Check Your Financial Aid Status

Use https://student.ufl.eduhttps://student.ufl.eduONE.UF “Aid Status” to:

- Find out if your financial aid file is complete or if you have outstanding requirements that will prevent the disbursement of your financial aid.

- Request student loans.

- Print verification documents.

To check your aid status:

- Go to https://student.ufl.eduhttps://student.ufl.eduONE.UF

- On the left menu, under “Financial Aid,” choose “Aid Status” for the correct academic year.

#top#top#top#top#top#top#top#top#top#top» top

Consumer Information

The University of Florida is committed to providing important information to its students, faculty and staff. Consistent with this commitment and pursuant to the university’s notice and reporting obligations under various laws, additional information can be found on the UF https://student.ufl.edu/consumerinfo.htmlconsumer information webpage.

#top#top#top#top#top#top#top#top#top#top» top

Credit Card Tips

Properly managing a credit card is a big responsibility. Credit cards can help establish and improve your credit score if they’re used properly. They can also damage your credit score and get you into serious debt if you don’t know what you’re doing. Use the tips below to make sound financial decisions.

Shop Around

Select a card that has the lowest interest rate and fee structure, and be sure to read the fine print. You’ll also need to know about late charges, other fees, and grace periods. Make sure you know the card’s Annual Percentage Rate (APR) and how it’s calculated. Shop around for the best deal and be wary of card offers that seem too good to be true.

Limit the Number of Cards You Have

One credit card should be sufficient. Applying for a lot of credit at any given time can hurt your credit score and possibly make you a high credit risk. This can affect your ability to get loans or to rent an apartment. In addition, closing several credit cards at once will trigger a decrease in your overall credit score.

Set Your Minimum Balance Low

This helps you control your spending habits. Spending up to your credit limit – or maxing out your credit card – suggests you could be a credit risk since you might be likely to overspend.

Pay off Your Balance Each Month

This takes discipline, and it saves you money in the long run. If you can’t pay off the entire balance on all of your credit cards, pay off your higher interest rate cards first and always pay off more than the minimum balance.

Avoid Late Payments

Late payments are bad for your credit, and a credit card company could use a single late payment as justification for raising your interest rate going forward. This could cost you hundreds (or even thousands) of dollars over time.

Review Your Monthly Statement

Save your receipts so you can carefully compare the charges on your credit card receipts with your records to ensure an accurate monthly statement.

Balance Wants vs. Needs

If you’ve had problems with impulse spending, don’t carry all of your credit cards with you. Consider carrying a single card for emergencies only. It also helps to think in terms of wants vs. needs when it comes to spending money with your credit card. By resisting the temptation to spend impulsively with credit cards, you can maintain a healthy credit score with little risk of getting in over your head.

Reconsider Large Purchases

If you are considering putting a large purchase on your credit card, put yourself through a waiting period before you actually make the purchase. Remember, a large purchase will need to be paid off sooner or later, and you want to make sure you’re paying the least amount of interest on your credit cards as possible.

Cash Advances

Beware – the cash looks attractive, but interest accrues from the moment you accept the cash, and you will also be assessed transaction fees. This means a quick $20 withdrawal from an ATM by using your credit card could easily cost you $30 or more.

#top#top#top#top#top#top#top#top#top#top» top

Mark Your Calendar to Apply for 2018-19 Financial Aid

The 2018-19 http://studentaid.gov/fafsaFAFSA will become available on October 1, 2017. UF’s “On-Time” deadline will be December 15, 2017. Apply well before December 15 to ensure that the federal processor has time to analyze and send the results of your FAFSA to our office. Remember to complete the FAFSA as soon as possible to be considered for the most and best aid.

Get free assistance at https://studentaid.gov/fafsahttps://studentaid.gov/fafsahttps://studentaid.gov/fafsastudentaid.gov or 1-800-433-3243 or

visit with your Student Financial Affairs financial aid adviser.

http://www.sfa.ufl.edu/contact-sfa/http://www.sfa.ufl.edu/contact-sfa/http://www.sfa.ufl.edu/contact-sfa/http://www.sfa.ufl.edu/contact-sfa/www.sfa.ufl.edu/contact-sfa

#top#top#top#top#top#top#top#top#top#top» top

Additional Financial Aid Information and Links

Scholarship Search

UF’s Scholarship Search Engine is a searchable database of both college-awarded and private scholarships. http://www.sfa.ufl.edu/search/www.sfa.ufl.edu/search

Visit the SFA Fall 2017 Calendar http://www.sfa.ufl.edu/resources/calendar/calendar.

Contact information for your financial aid adviser is available on http://www.sfa.ufl.edu/contact-sfa/http://www.sfa.ufl.edu/contact-sfa/http://www.sfa.ufl.edu/contact-sfa/http://www.sfa.ufl.edu/contact-sfa/SFA’s Contacts webpage.

Fall SFA News

The Fall 2017-18 issue of NEWS: Financial Aid for Gators — is available in http://www.sfa.ufl.edu/pub/news/1718FallNews.pdfPDF format for Fall 2017-18.

NEWS Financial Aid for Gators is produced once a semester by the Information/Publication Services section of the Office for Student Financial Affairs, to inform students about financial aid programs and services that help UF students meet educational costs.

Director: Rick Wilder

Editor: Sharon Eyman

NEWS: Financial Aid for Gators is available in other formats for students with documented, print-related disabilities. Students who are speech- or hearing-impaired can contact the Florida Relay Service. Dial 711 or 1-800-955-8771(TTY) http://www.ftri.org/FloridaRelayhttp://www.ftri.org/FloridaRelay

The University of Florida is committed to equal treatment of students without regard to race, creed, color, religion, age, disability, sex, sexual orientation, marital status, national origin, political opinions or affiliations, or veteran status.

http://www.sfa.ufl.edu/contact-sfa/http://www.sfa.ufl.edu/contact-sfa/http://www.sfa.ufl.edu/contact-sfa/http://www.sfa.ufl.edu/contact-sfa/Contact SFA

UF Federal School Code: 001535

Visit SFA on Social Media https://www.facebook.com/UFSFAFacebook https://twitter.com/UFSFATwitter https://www.instagram.com/ufsfa/Instagram https://www.youtube.com/user/UFSFAYouTube