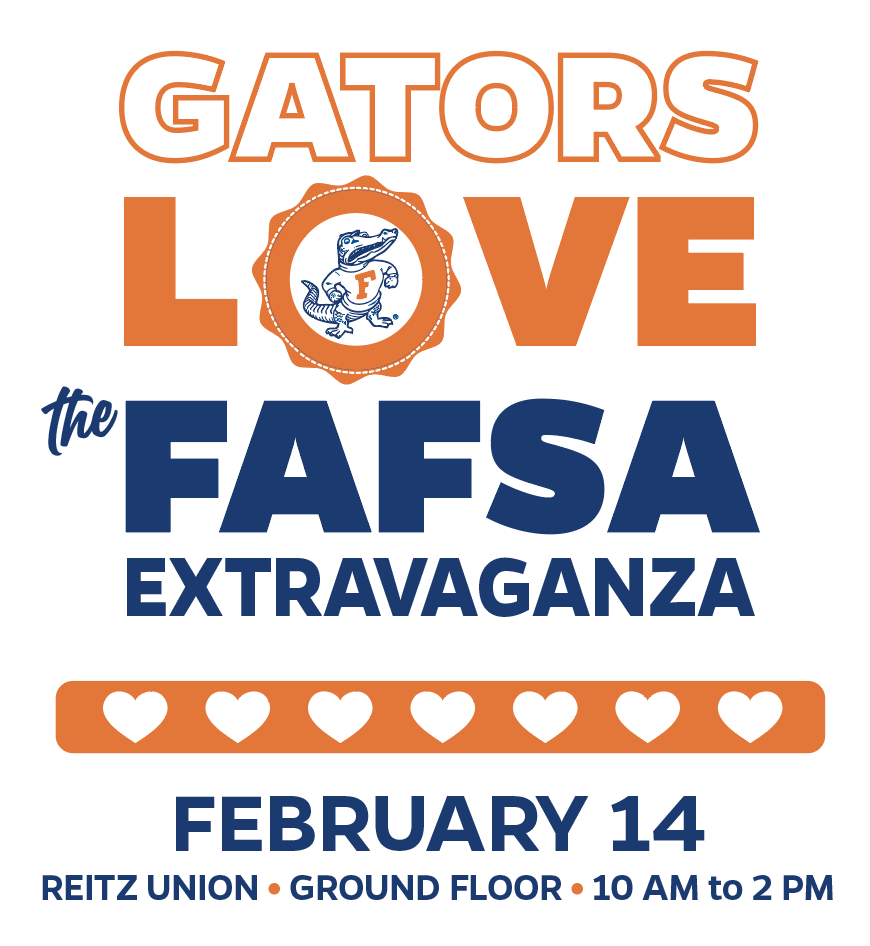

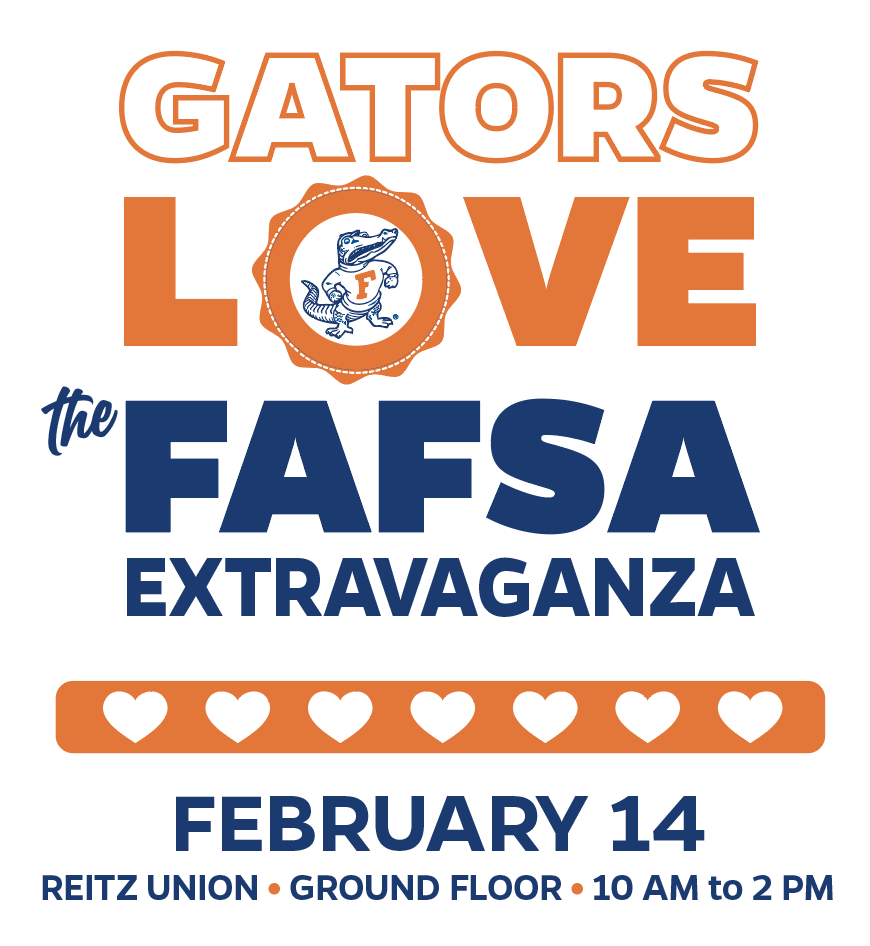

The 2024 FAFSA Extravaganza will be held on the ground floor of the Reitz Union on February 14 from 10am to 2pm.

Schedule of Events:

FAFSA Assistance & Aid Advising

10am-2:00pm, Reitz Union G320

SNAP Info/Resources Tabling

10am-Noon, Reitz Union G325

Everything Everywhere All at Once

Grad School, Undergrad Research, Jobs,

Internships, and Scholarship Opportunities

11am-Noon, Reitz Union G330

OneStop 101: A Journey to Student Success

11am-11:30pm, Reitz Union G310

Noon-12:30pm, Reitz Union G310

Tips and Tricks for Managing Your Finances in College

1pm-2pm, Reitz Union G330

Snacks • SWAG • T-Shirts • Raffle

while supplies last!

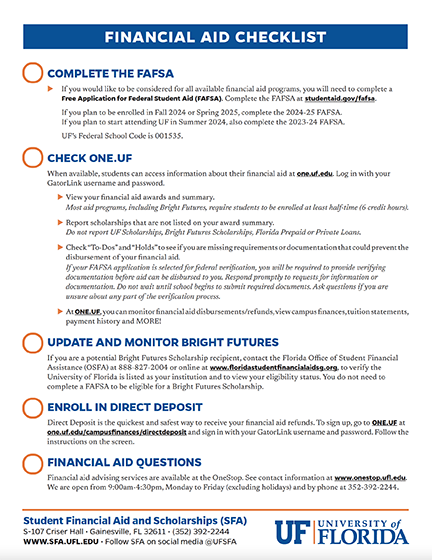

To apply for 2024-25 financial aid, complete the Free Application for Federal Student Aid (FAFSA) at www.fafsa.gov.

To receive the best financial aid offer, complete the 2024-25 FAFSA as early as possible. In order for UF Student Financial Aid and Scholarships to consider you for a financial aid package, you must be a degree-seeking, admitted student.

The Office of Academic Support, in partnership with the Office of Student Financial Aid and Scholarships, would like to thank the following UF partners for their support of the 2024 FAFSA Extravaganza:

Career Connections Center

Department of Family, Youth and Community Sciences

The Graduate School

Machen Florida Opportunity Scholars Program/First-Generation Student Success

UF Promise

UF Student Support Services

Center for Undergraduate Research

UF Student Government

Office of Academic Support

Student Financial Aid and Scholarships

Register for the 2024 FAFSA Extravaganza here!