Graduate PLUS Loans are loans for graduate and professional students who are ineligible for Unsubsidized Loans or need to supplement their Unsubsidized awards.

Graduate and professional students may borrow up to the student’s cost of attendance, minus other financial aid. Interest is charged during in-school, deferment, and grace periods. The borrower is responsible for the interest from the time the PLUS Loan is disbursed until it’s paid in full. You can choose to pay the interest or allow it to accrue (accumulate) and be capitalized (that is, added to the principal amount of your loan). Capitalizing the interest will increase the amount you have to repay.

Students should be aware that Graduate PLUS loans are subject to credit approval by the Department of Education.

| Borrower | Interest Rate (for loans disbursed from 7/1/23 to 7/1/24) |

Interest Rate (for loans disbursed from 7/1/22 to 7/1/23) |

Origination Fee (for loans disbursed from 10/1/21 to 9/30/23) |

|

|---|---|---|---|---|

| Student | 8.05% Fixed | 7.54% Fixed | 4.228% | |

| Deferment | You may receive a deferment if you are enrolled in school at least half-time and for an additional six months after you cease to be enrolled at least half-time. | |||

| Repayment | Repayment begins six months after you cease to be enrolled at least half-time. | |||

How Much Can I Borrow?

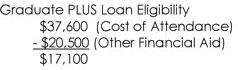

The maximum amount you can borrow each academic year is calculated by subtracting other financial aid from your cost of attendance. Direct loan eligibility and loan request amount must be greater than $350 for a PLUS or Grad PLUS loan to be processed.

Example

Alberta Gator is a first year graduate student. Her cost of attendance for Fall and Spring terms is $37,600 and her other financial aid (such as grants, scholarships and Unsubsidized Loans) totals $20,500.

Alberta would be able to borrow up to $17,100 in a Graduate PLUS Loan.

To Apply for a Graduate PLUS Loan:

- Complete a FAFSA (Free Application for Federal Student Aid) at http://www.fafsa.govwww.fafsa.gov.

To be Eligible You Must:

- be a U.S. citizen, national or permanent resident;

- be enrolled at least half-time;

- not have defaulted or owe a refund to any previous aid program;

- maintain satisfactory http://www.sfa.ufl.edu/process/additional-information/satisfactory-academic-progress-policy/academic progress; and

- have no adverse credit history.

To Receive Your Graduate PLUS Loan:

- Request the PLUS loan through https://studentaid.govhttps://studentaid.govhttps://studentaid.govhttps://studentaid.govStudentaid.gov using the graduate student’s FSA ID.

- Complete PLUS Counseling if required using https://studentaid.govhttps://studentaid.govhttps://studentaid.govhttps://studentaid.govStudentaid.gov. PLUS Counseling is required if you initially do not pass a credit check but are approved because you obtain an endorser or you appeal your denial and submit supporting documentation. Note that PLUS loan counseling is separate from the PLUS Loan Entrance Counseling that all graduate and professional student PLUS Loan first time borrowers must complete.

- Complete Entrance Counseling for Graduate PLUS Loans using https://studentaid.govhttps://studentaid.govhttps://studentaid.govhttps://studentaid.govStudentaid.gov.

- Sign a Master Promissory Note (MPN) using https://studentaid.govhttps://studentaid.govhttps://studentaid.govhttps://studentaid.govStudentaid.gov.

NOTE: You cannot change the amount of a PLUS loan once awarded by UF. Visit an SFA financial aid adviser in S-107 Criser Hall with questions or to update loan amounts.

For more information about financial aid disbursement, see http://www.sfa.ufl.edu/process/receiving-your-aid/“Receiving Aid.”